Netflix is Optimizing, YouTube is Expanding

Remember when Netflix said there would be no ads - ever?

That wasn’t just a business model. It was an ethos.

The Reed Hastings era was defined by a radical commitment to the user:

Deliver extraordinary value for money

Never compromise the member experience

Disrupt the entire TV industry

They didn’t call people “users.” They called them members. And they meant it.

But now?

Since Reed stepped down and passed the reins to Ted Sarandos and Greg Peters, the strategy has flipped:

Ads? Now standard.

Account sharing? Cracked down.

Prices? Raised, and raised again.

Subscriber counts? No longer reported.

Netflix is no longer building goodwill. It’s cashing in on the goodwill that Reed built.

And it’s showing up in the data.

Netflix lost U.S. subscribers in the first five months of 2025 - right after they stopped reporting subscriber numbers.

According to Antenna:

Gross adds fell 25% year over year

Cancels rose 18%

The result: net subscriber losses in the U.S. for the first time in recent memory

The adds-to-cancels ratio dropped to just 0.9x, the lowest it’s been in three years Antenna “Netflix Volatility” – May 2025

Meanwhile, MoffettNathanson reports that Netflix’s revenue per hour watched is now around $0.40, nearly catching up to the legacy cable networks, who are notorious for squeezing every penny out of their audiences.

So yes, revenue per user is up. But the number of users is heading in the other direction.

Meanwhile, YouTube is still playing offense.

Despite generating over $54B in revenue last year (per MoffettNathanson estimates), YouTube is still under-monetizing by design.

On connected TVs, YouTube earns just $0.18 per hour viewed on connected TVs, lower than every major AVOD, and far below its potential.

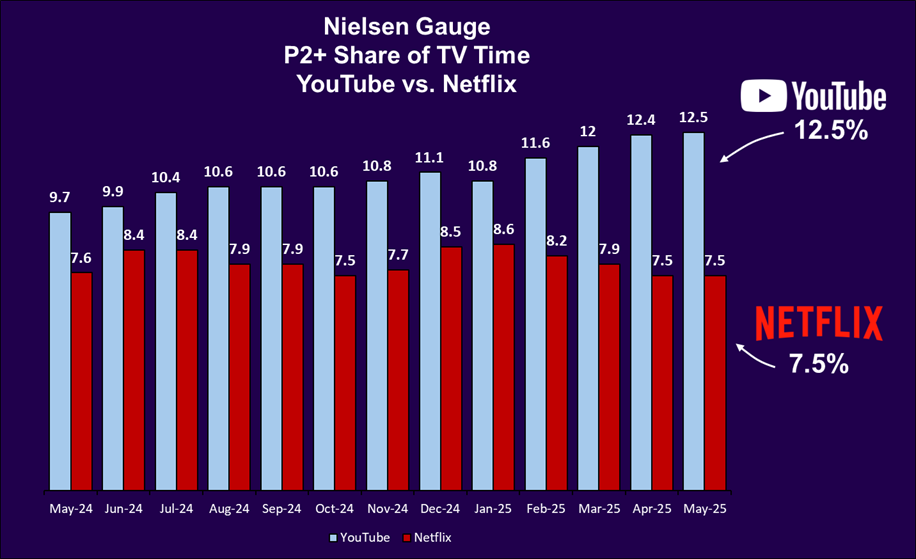

YouTube is now the most-watched TV platform in America, per Nielsen. It commands 12.5% of all TV viewing as of May 2025 - more than Netflix, Prime Video, Disney+, or anyone else.

And that number isn’t flat. It’s still growing. Fast.

One year ago, YouTube held 9.7% share of TV viewing. Now it's at 12.5%. That’s a 29% year-over-year increase - off an already dominant base.

Its viewership now dwarfs Netflix’s, not just in total minutes, but in trajectory.

And it’s not just Gen Z anymore. The fastest-growing demographic in 2024 was adults 65 and older, up 32% year-over-year.

The Bigger Picture

MoffettNathanson estimates YouTube’s standalone valuation at $475-$550 billion.

That makes YouTube:

On par with - or likely larger than - Netflix

Bigger than Disney

Bigger than the rest of the media industry combined

But unlike the rest, YouTube hasn’t pulled the monetization ripcord.

Netflix is optimizing. YouTube is expanding.

Netflix is cashing in. YouTube is still earning it.

The Opportunity Ahead

Revenue per hour viewed has a ceiling. There’s only so much you can extract before you max out.

Netflix is pulling every lever - ads, price hikes, account sharing crackdowns - and catching up to traditional networks on revenue per hour. But once they hit that ceiling, there’s nowhere left to go.

YouTube, on the other hand?

They haven’t even started trying.

When YouTube decides to fully monetize, they won’t just increase revenue per hour...

They’ll define the next era of revenue in media.